In the latest instalment of our energy management industry executive interview series we spoke to ON-SITE Energy CEO David Kipling about the company, the biggest challenges faced by the sector right now, upcoming trends to watch out for and the potential of solar PV…

In the latest instalment of our energy management industry executive interview series we spoke to ON-SITE Energy CEO David Kipling about the company, the biggest challenges faced by the sector right now, upcoming trends to watch out for and the potential of solar PV…

Tell us about your company, products and services.

DK: The inspiration for ON-SITE came from my previous role where I led a team addressing energy in over 100 manufacturing plants globally. We saw the value of data-led energy analysis in identifying more than 50% savings but we found in practice we could only execute those measures with a short payback.

With the pressure now on achieving better sustainability, and on reducing costs, companies are going to have to find a way of doing the longer payback measures that until now sit on the shelf. This is what ON-SITE is about – we help unblock long payback capex and enable the measures to happen. We work with our customers to identify measures with a data-led approach, and then implement them using our money, with no contribution from the customer. We effectively keep some of the savings to pay for our returns, and pass the remainder on to the customer through lower energy costs. This way we can also help companies embrace net zero much faster.

We work with energy intensive manufacturing companies, and cover a wide range of technologies including efficiency measures, onsite generation and heat recovery. We think its important to identify the most appropriate measures and which will have most impact, so we keep an open mind on what we recommend and are instead guided by the data.

What have been the biggest challenges the Energy Management industry has faced over the past 12 months?

DK: The crisis of rising energy costs that started last Autumn has brought sharp focus on energy costs for many. It really has shown the value of energy hedging but also the risks of what happens when your hedge ends and you face the market again. Our view is the best way of defending your business from the market prices in the long term is (1) consume less through investing in energy efficiency measures and (2) invest in your own generation, which is usually much cheaper and efficient, so that between these two steps you minimise your exposure..

And what have been the biggest opportunities?

DK: Net Zero. Most significant businesses now have a sustainability strategy with goals for achieving carbon neutral, but a lot have also had capex capped for at least the next few years because of COVID-19. The pressure for change is building, and the main obstacles are capex and sometimes innovation. We can help with both of these with our zero capex approach, and enable companies to stay on track or even accelerate their plans.

What is the biggest priority for the Energy Management industry in 2022?

DK: I would say that underlying its still decarbonisation, but the cost pressures of the last six months means that reducing energy costs on a long term basis will take priority.

Fundamentally your business needs to be viable to be sustainable, so costs need to be addressed.. The good news is that sustainability improvement goes hand in hand with savings, so accelerating your sustainability plans can also mean lower energy costs.

The biggest challenge will be decarbonisation of heat – in other words planning to switch from gas to electricity. This will be a massive change for gas hungry businesses. I think this will be an increasing priority given the recent cost of gas, and increasing talk about hydrogen (albeit that’s still years away). For a lot of businesses that will mean significant additional cost unless they develop a comprehensive approach and plan.

What are the main trends you are expecting to see in the market in 2022/23?

DK: I see two things – there is going to be a bigger push on onsite generation to reduce costs, and also the next round of ESOS is due by end 2023, and its likely it will be mandatory by then to have to enact the measures reported. Its going to result in a lot of challenges to auditor findings, but its also going to bring a focus on getting ahead of the game and being proactive in addressing points.

What technology is going to have the biggest impact on the market this year?

DK: I think its going to be solar PV. Its cheap, fairly fast to deploy and can provide some relief for businesses against the high energy costs. The issue is its usually limited impact in manufacturer’s energy costs. For much larger savings you can’t beat CHP currently, but the key is using the heat constructively to reduce other fossil fuels.

In 2025 we’ll all be talking about…?

DK: 100% Hydrogen-ready CHP. The technology already is in market, but there isn’t much hydrogen available to use it. Whilst the initial reaction for some is its more gas usage, CHP could be the transition technology to 24/7 zero carbon onsite generation once hydrogen is available.

Which person in, or associated with, the Energy Management industry would you most like to meet?

DK: Lisa Rose of Forum Events (again) ! Lisa’s an enthusiast and is great at making people talk. We need more Lisa’s ! It was good to get back to some face to face networking last year at the energy management event in London. Looking forward to this October.

What’s the most surprising thing you’ve learnt about the Energy Management sector?

DK: I think people enjoy learning about opportunities they hadn’t previously known about, which can be brought about by new technologies . It’s an exciting space which is innovating fast. It also has a meaningful impact on both business profits and on climate change and sustainability, so the people in the Energy Management space are often driven by the benefits they can deliver.

You go to the bar at the Energy Management Summit – what’s your tipple of choice?

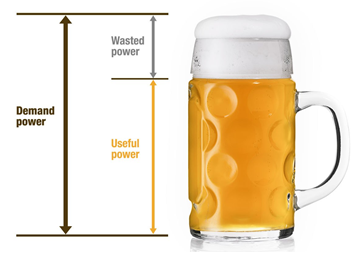

DK: Mine’s a pint !

What’s the most exciting thing about your job?

DK: Delivering new insights and levels of savings not thought possible

And what’s the most challenging?

DK: Countering the “we’ve seen it before” response. Reality is if they saw exactly “it” previously, then “it” has either changed massively or it wasn’t approached in the way we would use it. It doesn’t hurt to take 15 minutes to see if you can learn something.

What’s the best piece of advice you’ve ever been given?

DK: A quick “no” is better than a slow “no”.

Peaky Blinders or Stranger Things?

DK: My TV watching is limited to repeats of Top Gear.

In the latest instalment of our energy management industry executive interview series we spoke to

In the latest instalment of our energy management industry executive interview series we spoke to