EUDR ‘could cost EU consumers up to $1.5 billion’, say analysts

https://energymanagementsummit.co.uk/wp-content/uploads/2018/12/Brexit.jpg 960 640 Stuart O'Brien Stuart O'Brien https://secure.gravatar.com/avatar/81af0597d5c9bfe2231f1397b411745a?s=96&d=mm&r=gA new study has explored the impact of EU Sustainability Regulations and the implications of the new EU Deforestation Regulation (EUDR) for global commodity supply chains and consumer markets.

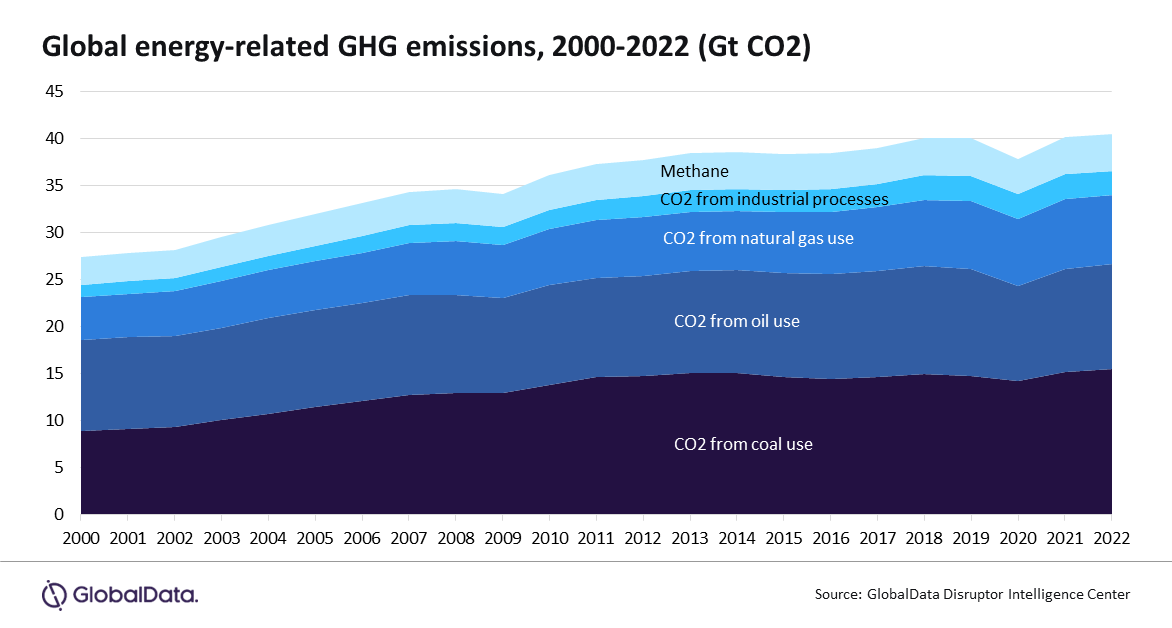

The EU Deforestation Regulation (EUDR), which comes into force at the end of the year, is the latest round of EU sustainability regulation which attempts to influence global regulatory policy and value-chain practices as part of the bloc’s effort to achieve key aims of The European Green Deal such as no net emissions of greenhouse gases by 2050.

The EUDR is arguably one of the most far reaching and impactful pieces of EU sustainability regulation, targeting commodities linked to deforestation, which includes cattle, cocoa, coffee, oil palm, rubber, soya, and wood as well as some of their derived products, such as paper/paperboard, leather, shampoo, chocolate, tyres, and furniture.

Under the EUDR companies that trade in these commodities and their derived products in the EU market or who export them from the EU will need to follow mandatory due diligence reporting of the goods and supply chains they wish to trade in and demonstrate that their products are not linked to deforestation, or to forest degradation through, for example, the expansion of agricultural land. The regulation will require companies and industries in countries that supply the EU to transition to a sustainable, deforestation-free supply chain and legal agricultural value chain if they wish to trade in the EU.

Agribusiness Consultants at GlobalData a leading data and analytics company estimate that EUDR compliance premiums for companies operating in the supply chain for just two of the targeted commodities, oil palm products and their derivatives (such as crude palm oil (CPO) and palm kernel oil (KPO)), and rubber could be in excess of $1.5 billion alone. Whilst companies operating in these supply chains will be able to absorb some of the costs themselves a good proportion of these compliance premiums are likely to be passed onto EU consumers in the form of food and drinks and product price increases.

GlobalData Food & Beverages Consultants’ new study: ‘EU Sustainability Regulations: How the EUDR and other Sustainability Regulations will impact consumer markets’, explores some of the EUs key sustainability regulations focusing on the aims of the EUDR and the compliance challenges ahead for farmers, companies, and manufacturers trading in the commodities targeted by the regulation.

The study also looks at what the EUDR could mean for the global supply chain of the target commodities, the potential impact on consumer markets and pricing within the EU and how the EUDR could affect the bloc’s future competitiveness with China.

With the EUDR coming into full force on 30th December 2024 for large companies (2025 for SME’s), the new study is also a timely reminder for large companies operating in the Food & Beverages, Foodservice, Retail and Packaging sectors to finalise their EUDR compliance strategy over the next six months to avoid being late in aligning their operations with the new EUDR rules.

It could be argued that the EU aims to use the ‘Brussels effect’ to direct global policy on sustainability. This is the idea that the global landscape responds to the EU ‘externalizing’ its laws because the bloc is such a significant global consumer market. According to **Eurostat, the EU has a population of over 448.7 million people, one of the biggest consumer markets in the world.

The European Investment Bank predicts that the EUs various climate actions could result in a potential hit to EU-wide GDP of -0.4% by 2030, taking into account all of the EUs sustainability initiatives, but says the costs of not acting would be greater.

Fred Diamond Senior Food & Beverages Consultant and Analyst at GlobalData, said: “The aims of the EUDR are understandable and cutting greenhouse gas emissions and protecting biodiversity is essential. However, there could be some disruption ahead. The extra demands of the EUDR could lead some commodity suppliers in what the EU terms ‘third countries’ to move away from the EU and increase trade with countries that impose fewer regulatory requirements such as China. Some food categories, such as plant-based meat, may have to reformulate and switch to other protein sources, such as pea protein if the result of the EUDR is an increase in the price of soya for food production.

“The gap between big and small companies could get wider as larger companies are more able to shoulder the additional regulatory burden. The exact impact on consumers will depend on a variety of factors, including how companies choose to respond to the regulation, the extent to which the regulation is enforced, and how much assistance EU member states are willing to give to supplier countries to help them align with the new rules. However, with recent news reports confirming that the world’s top climate scientists expect global heating to go well beyond the current 1.5C target, sustainability regulation associated with cutting greenhouse gas emissions, such as the EUDR which targets deforestation, remains an urgent priority for the planet.”