Cutting-edge innovations ‘driving investment boom’ in green hydrogen

https://energymanagementsummit.co.uk/wp-content/uploads/2023/02/JCBHydrogenCombustionEngine-2.jpg 960 640 Stuart O'Brien Stuart O'Brien https://secure.gravatar.com/avatar/81af0597d5c9bfe2231f1397b411745a?s=96&d=mm&r=gThe clean energy landscape is gaining significant momentum in 2024, fuelled by substantial support from major economies and venture capitalists propelling the advancement of green hydrogen technology.

Recent months have witnessed a pronounced uptick in interest and investment in this domain. At the forefront of this innovative wave is green hydrogen, a pioneering technology for producing net-zero, clean fuel.

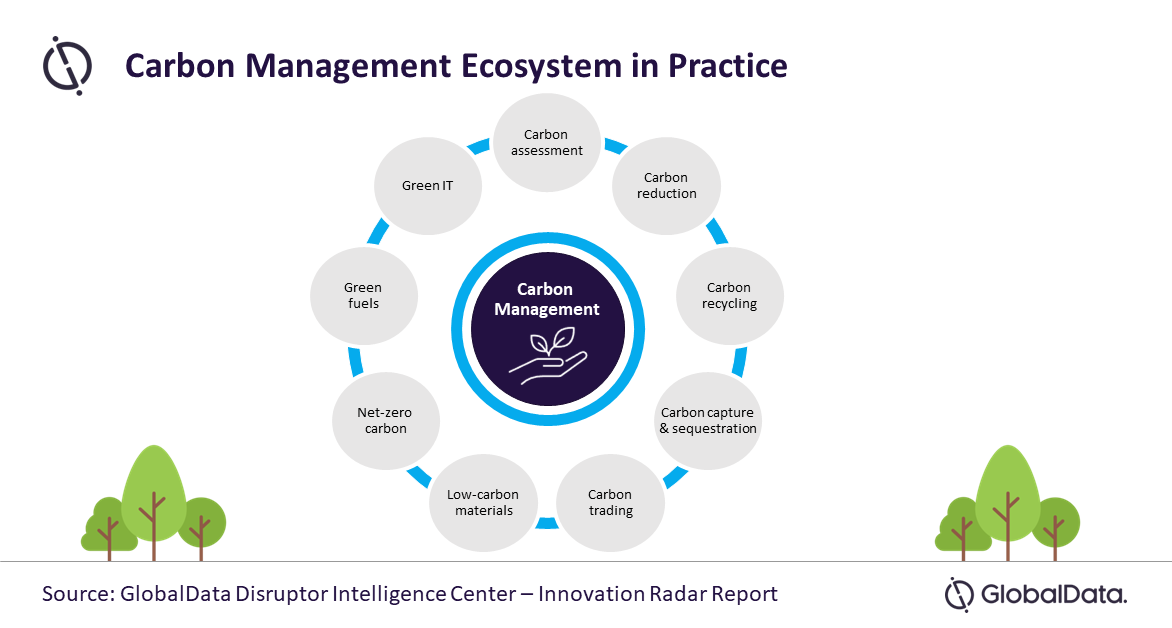

This rising trend is also fueled by several high impact innovations in green hydrogen technology, as highlighted by Technology Foresights, a proprietary framework developed by GlobalData.

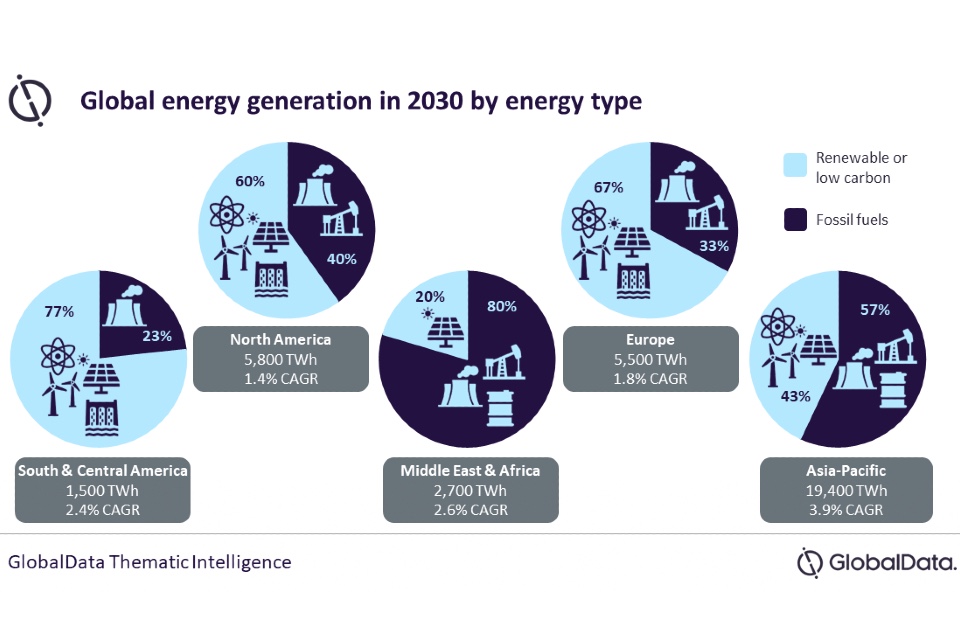

Globally, the surge in interest surrounding green hydrogen is unmistakable, underscored by significant developments in various regions. In India, projects valued at $2 billion have received clearance, with plans to invest up to $12 billion in the coming years dedicated to green hydrogen production. Mirroring this commitment, Italy has earmarked a substantial $1.1 billion fund specifically for the establishment of electrolyzer factories crucial to green hydrogen processes.

Notably, Morocco is aligning with this global trend, designating 1 million hectares of land for green hydrogen production. This momentum is further accentuated by substantial venture capital investments, as evidenced by leading investors such as TPG Capital and Temasek injecting multimillion-dollar funds into green hydrogen startups in recent months. These developments underscore a growing global interest in green hydrogen, propelled by both governmental initiatives and private sector investments.

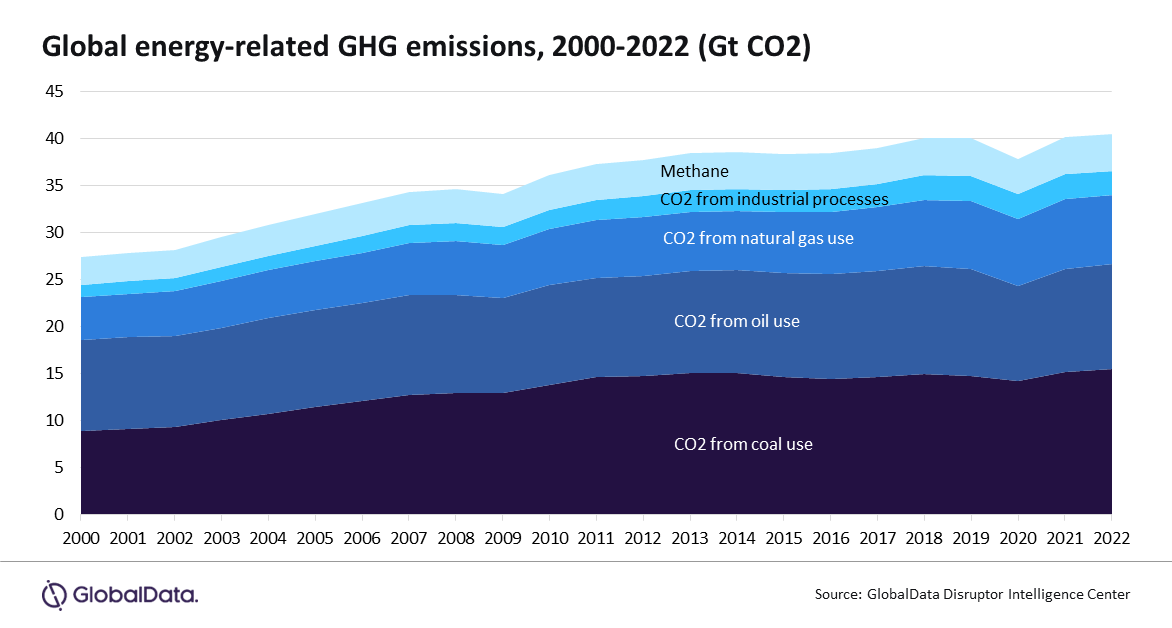

Sourabh Nyalkalkar, Practice Head of Innovation Products at GlobalData, comments: “The evolution of hydrogen production technologies reflects a significant shift from carbon-positive to net-zero carbon solutions. The industry has transitioned from conventional syngas or methane reforming methods, associated with carbon emissions, to advanced technologies leveraging renewable sources like solar and hydro for hydrogen production. Notably, the innovation radar for green hydrogen highlights emerging technologies such as photocatalyst electrodes and electrochemical water splitting, anticipated to be impactful innovations in the long run. This progression underscores a concerted effort towards sustainable and environmentally friendly hydrogen production methods.”

Key players in green hydrogen production technology, such as Toshiba, Panasonic, and Topsoe, are at the forefront of innovation in photocatalyst electrodes. These industry leaders are expanding their focus beyond traditional materials like titanium and zinc, aiming to develop highly efficient electrodes capable of facilitating electrochemical reactions for hydrogen production. Importantly, these major players are securing contracts from public entities to establish hydrogen production facilities. For instance, Panasonic received orders from Greater Manchester, while Topsoe successfully secured projects from the Australian government, supplying technology crucial for green hydrogen production.

Nyalkalkar concludes: “The green hydrogen startup landscape is currently ablaze with innovation, attracting substantial investments from prominent stakeholders worldwide. In the first quarter of 2024 alone, leaders in the photocatalyst electrode startup landscape monitored on Technology Foresights, including Sunfire, Ohmium, and Verdagy, have collectively raised nearly $500 million from top-tier venture investors. This surge in investment and innovation activities suggests a promising future for the industry, prompting stakeholders in the energy sector to stay vigilant.

“To capitalize on this growing momentum, strategic pivots and exploration of new growth opportunities through collaborations and acquisitions are essential for securing a foothold in this rapidly evolving and promising space.”