Can the blockchain steer the course of oil and gas usage?

https://energymanagementsummit.co.uk/wp-content/uploads/2024/04/blockchain-shubham-dhage-T9rKvI3N0NM-unsplash.jpg 960 640 Stuart O'Brien Stuart O'Brien https://secure.gravatar.com/avatar/81af0597d5c9bfe2231f1397b411745a?s=96&d=mm&r=gBlockchain is emerging as a technology that demands attention within the oil and gas sector, presenting novel approaches to service contracts, review pricing, and support the entirety of the transaction life cycle.

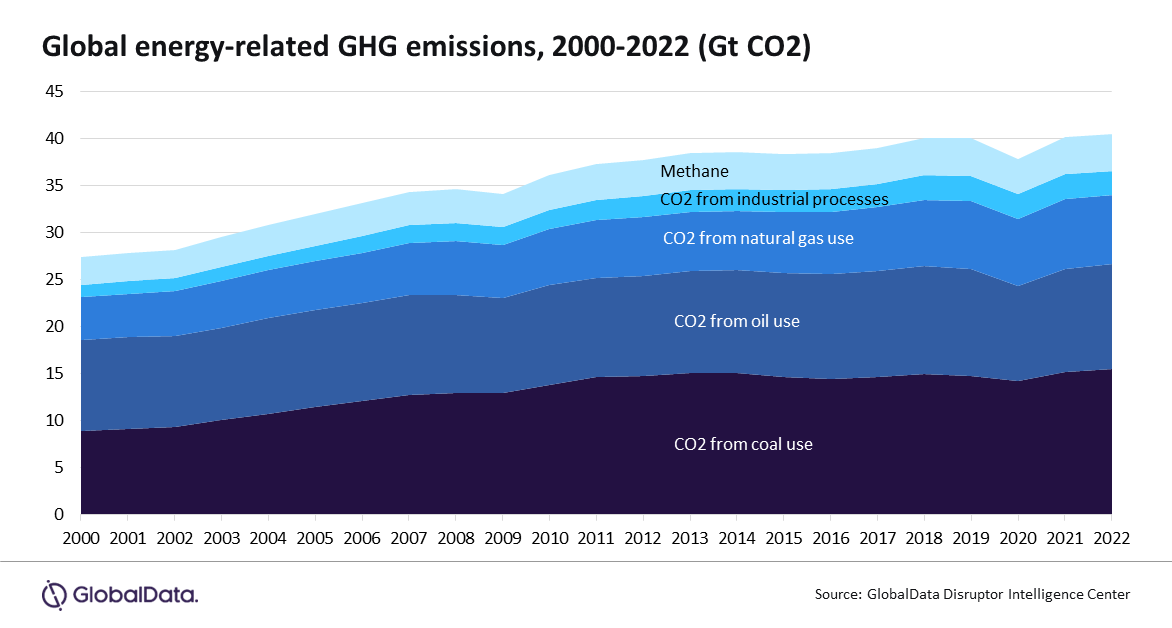

That’s according to analysts at GlobalData, which say the blockchain promises potential cost reductions and enhanced process efficiencies.

Moreover, it argues the advantages of blockchain in the oil and gas industry manifest through enhanced transparency, compliance, and data security.

GlobalData’s thematic report, “Blockchain in Oil and Gas,” provides an overview of the blockchain technology and its potential implications in oil and gas operations. It also highlights the role of major oil and gas companies, such as ADNOC, BP, Eni, Equinor, Repsol, and Shell in the development of blockchain to address their challenges.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, said: “While the initial use focused on supply chain optimization, blockchain has evolved considerably in recent years to support transaction processing with smart contracts. Moreover, the establishment of consortiums has helped to standardize protocols and exchange best practices. With the maturation of the technology, its adoption is expected to expand, ushering in improved transparency, efficiency, and security in operations.”

Blockchain has a range of compelling applications within the oil and gas industry. It has the potential to accelerate digital transformation using sensors and cloud computing. The tokenization of physical assets has also emerged as a promising application.

Puranik continued: “Tokenization involves digitizing a tangible asset for managing big data or safeguarding sensitive information. It has the potential to streamline bureaucratic processes during the production, transportation of processing of a natural resource across various jurisdictions. A token can facilitate transparency in tracking the movement of natural resources throughout the developmental phases. This transparency not only highlights opportunities to minimize waste but also aids in identifying potential irregularities, thereby aiding the sector in fortifying its reputation at a time when it faces challenges from alternative energy sources.”

With the hype around blockchain subsiding, adoption is quietly increasing, focusing on practical benefits and efficiency gains rather than technological novelty. The realization that blockchain’s fit may not be universal, coupled with the importance of having a strong digital infrastructure in place, will continue to drive the trend toward meaningful implementation.

Puranik concluded: “As sensor technology reaches its peak within the industry amid rising adoption of the Internet of Things (IoT), blockchain facilitates the direct storage of transactions and accounting data on these devices. By linking assets directly to service contracts, blockchain significantly diminishes processing time and fundamentally alters contracting by providing secure collaboration. Although adoption is currently in its early stages, the potential of blockchain in the oil and gas sector is poised for substantial growth as companies recognize its full capabilities.”

Photo by Shubham Dhage on Unsplash